Center on Financial Risk in Environmental Systems: Tampa Bay

Tampa Bay

Project Title

Water supply infrastructure investment requires adaptive financial assessment: an enhanced exploratory modeling framework to evaluate coupled financial and water supply dynamics

Summary:

Water managers must constantly balance investment in infrastructure upgrades to ensure reliable water supply with the affordability of water rates for consumers. As a result, trade-offs between water supply and financial objectives have become central to the long-term sustainability of utility operations. Few studies, however, have directly quantified decision-relevant financial benchmarks of water supply system adaptation. Benchmarks include debt covenants, guidelines required by creditors seeking assurance that debt will be repaid. Violation of covenant thresholds risks a downgrade of a utility’s credit rating, higher interest rates on future debt, and higher costs for new infrastructure.

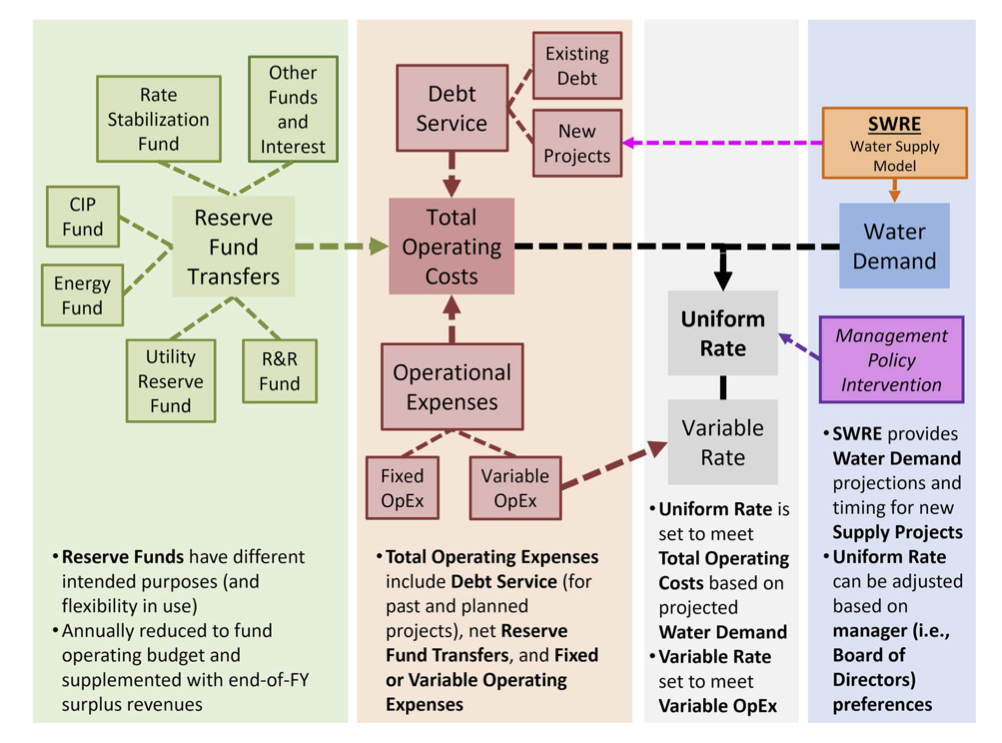

Flowchart linking water resource model (SWRE) outputs of water deliveries and infrastructure expansion timing to annual financial model flows associated with revenues and costs.

Description:

This work introduces an exploratory modeling framework that carefully couples adaptive water supply planning with financial modeling to better track how utility budgetary decision-making can adapt to infrastructure expansion and future water demand growth. Demonstrated through an evaluation of infrastructure planning for Tampa Bay Water (TBW), results showcase TBW budgetary adaptation in response to water demand growth and supply expansion, quantifying the financial implications of infrastructure planning decisions and demand growth on water rates as well as the bond covenants. This study underscores the importance of integrating dynamic and adaptive financial modeling in providing realistic decision support that addresses both supply reliability and financial stability.

Related Publications:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Gorelick, D. E.P, Gold, D. F., Asefa, T., Svrdlin, S., Wang, H., Wanakule, N., Reed, P. M. and G. W. Characklis (2023). “Water supply infrastructure investment requires adaptive financial assessment: an enhanced exploratory modeling framework to evaluate coupled financial and water supply dynamics,” Journal of Water Resources Planning and Management, 149(3), 04022084. DOI:10.1061/JWRMD5.WRENG-5863

Collaborators:

Dr. Pat Reed, Cornell

Dr. Tirusew Asefa, Tampa Bay Water

Sandro Svrdlin, Tampa Bay Water

Dr. Nisai Wanakule, Tampa Bay Water

Dr. Hui Wang, Tampa Bay Water

Funding Support:

Tampa Bay Water

William R. Kenan, Jr. Charitable Trust