Center on Financial Risk in Environmental Systems: Coastal Carolina

Coastal Carolina

Project Title:

Systemic financial risk arising from residential flood losses

Summary:

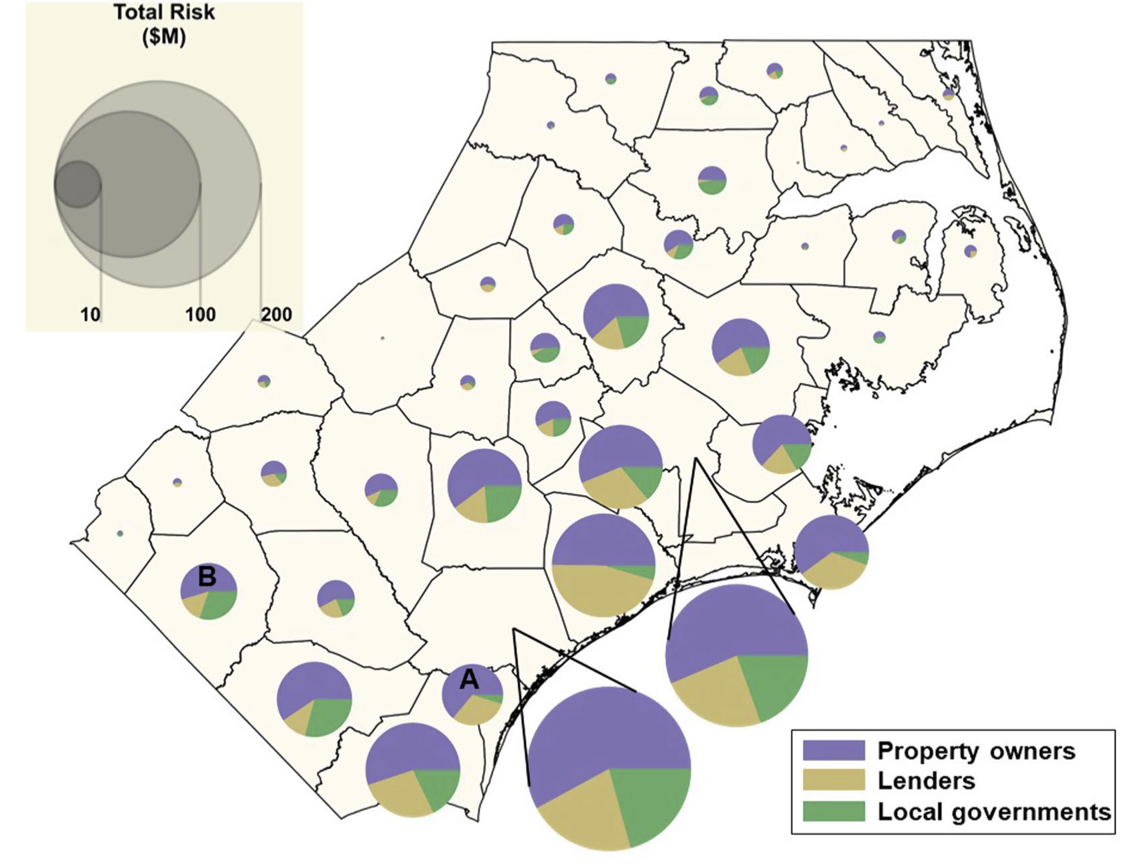

Flood-related financial risks impact more than just property owners, often expanding to other groups including lenders and local governments. These risks have never been fully characterized and must be understood if lenders and local governments are to have the financial resources to assist their communities in building more resilient strategies for recovering from these events. This information is also useful in evaluating the impact of actions such as encouraging greater uptake of flood insurance (e.g., subsidies) and targeted programs for reducing a community’s flood-based financial risk (e.g., buyouts).

County-by-county financial risk distributions with a magnitude of total county risk represented by the size of the pie chart (see inset).

Description:

The financial impacts of flooding are complex and their distribution across different groups is difficult to quantify. Traditionally, the focus has been on estimating damages that directly impact insurers and property owners, but lenders and local governments can also be affected. Following a flood, uninsured damage and reductions in property value can combine to reduce a property owner’s equity, hampering their ability to borrow money and recover from the flood. This can lead to mortgage default or even property abandonment, resulting in financial consequences for the property owner, the mortgage lender, and/or the local government. This research estimates uninsured damage and property value changes throughout eastern North Carolina. The analysis is done in the aftermath of Hurricane Florence using a novel machine-learning approach based on data describing the physical characteristics of residential properties, insurance claims, property sales, and mortgages. Results indicate that uninsured damage and property value decreases combined to be substantial and that this combination significantly increased the risk of mortgage default and/or property abandonment. Lower-valued properties experienced higher rates of default and abandonment than high-valued properties, with risk varying widely across communities. This type of analysis allows for programs designed to reduce community financial risk to be targeted toward the most vulnerable.

Collaborators:

Dr. Antonia Sebastian, Earth, Marine and Environmental Sciences, UNC

Related Publications:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Thomson, H.M, Zeff, H. B.R, Kleiman, R.M, Sebastian, A. and G. W. Characklis (2023). “Systemic financial risk arising from residential flood losses,” Earth’s Future, 11(4), e2022EF003206, https://doi.org/10.1029/2022EF00320

Funding Support:

North Carolina Collaboratory

UNC Institute for the Environment