Center on Financial Risk in Environmental Systems: Columbia River Basin

Columbia River Basin

Project 1 Title

Assessing the Bonneville Power Administration’s Financial Vulnerability to Hydrologic Variability

Summary:

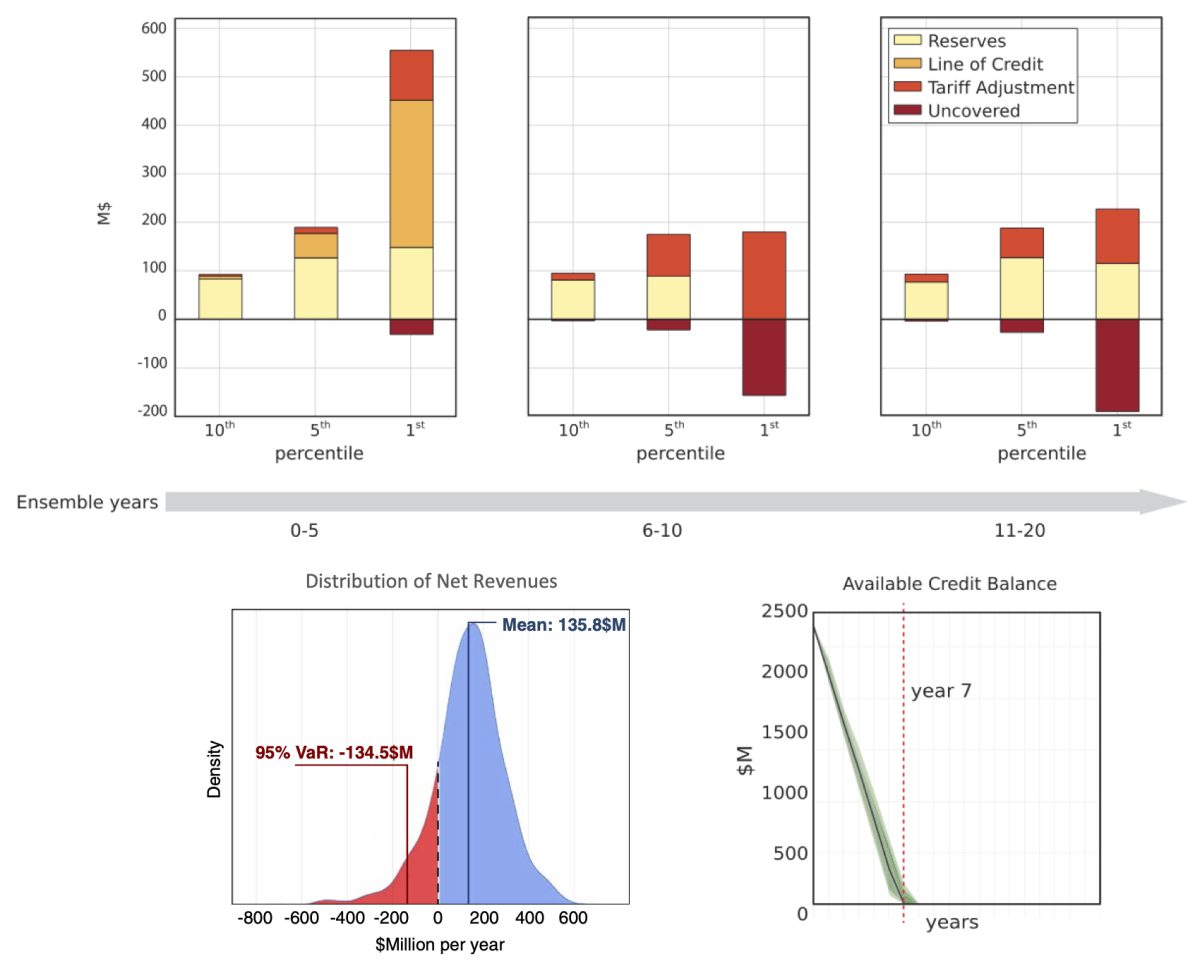

Drought forces hydropower producers to reduce electricity generation which translates into lower revenues, even as their costs remain roughly constant (e.g., debt service, personnel costs), thus exposing them to financial risk. Sophisticated producers such as BPA rely on a layered financial risk management strategy to combat drought-related losses which can include cash reserves, a line of credit and tariff adjustments, but during severe drought these are insufficient to avoid uncovered losses. In the case of BPA these losses can be on the order of hundreds of millions of dollars.

BPA’s distribution of net revenues (lower left), assumptions regarding drawdown of its line of credit (lower right) and the performance of its financial risk management strategy under the more extreme conditions (losses higher than the 90th percentile) (top). Results are split in time to show how BPA’s strategy changes when the line of credit is exhausted.

Description:

Hydrologic variability can cause large swings in hydropower generation, inducing significant volatility in power sales. Dry years often result in low revenues that can threaten a hydropower supplier’s ability to meet its fixed costs, leading to budget shortfalls, lower credit ratings, higher interest rates, and, ultimately, higher prices for customers. This is particularly true for suppliers in hydropower-dominated regions, such as the Bonneville Power Administration (BPA) whose strategy for managing its hydrologic financial risk is multilayered, involving cash reserves, a line of credit, and tariff adjustments. Yet, compared to its long-term energy contracts and debt service, BPA’s risk assessment is conducted on a short-term basis, thereby neglecting medium- and long-term temporal dynamics impacting their financial risk. This research focuses on (1) evaluating BPA’s hydrologic financial risk, and; (2) testing the effectiveness of BPA’s existing risk management strategy. Results suggest that BPA’s financial risk will grow substantially over the next 20 years as its risk management tools become increasingly inadequate, providing cautionary lessons for organizations in similarly hydro-dominated systems despite the current use of common risk management tools.

Related Publications:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Denaro, S.P, Cuppari, R. I.D, Kern, J. D., Su, Y.D and G. W. Characklis (2022). “Assessing the Bonneville Power Administration’s Financial Risk Management Strategies,” Journal of Water Resources Planning and Management, 148(10), 05022006, DOI: 10.1061/(ASCE)WR.1943-5452.0001590

Project 2 Title:

Comparing Alternatives for Managing Financial Risk for Hydropower Suppliers

Summary:

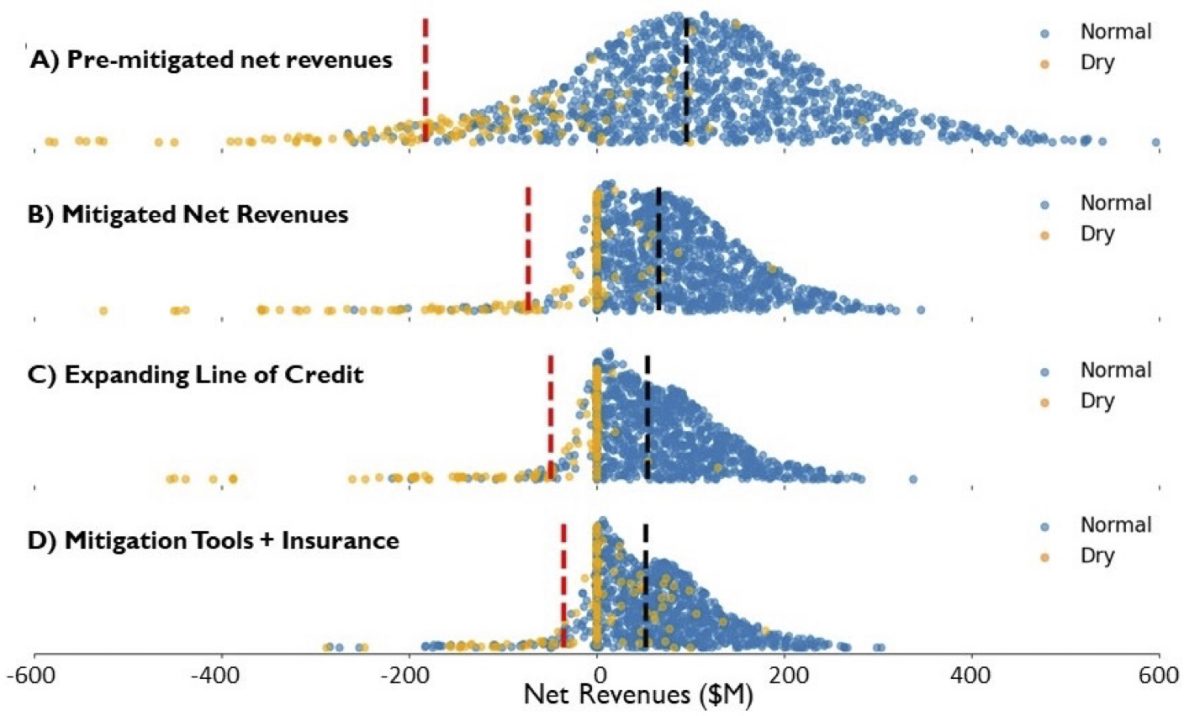

Hydropower operations are financially vulnerable to drought, which reduces generation and related revenues and, in some cases, can also increase costs if generators are forced to buy expensive supplemental power in order to meet firm supply contracts. Correlated risks involving both extremely dry and hot conditions, with the latter leading to increased electricity prices, can lead to even more financially disruptive events. Operators have long managed these risks using traditional financial tools including reserve funds, access to debt and tariff adjustments, but growing weather volatility, market reforms and increased scrutiny from investors, lenders and customers are driving the search for new financial instruments to better manage risk.

Comparison of distributions of BPA’s annual net revenues across four scenarios. Panel A shows raw, unmitigated net revenues while panel B illustrates net revenues when risk is mitigated using reserves and the line of credit. Panel C shows net revenues after risk mitigation using an expanding line of credit, and Panel D highlights the risk management potential of a newly developed index insurance contract.

Description:

The Bonneville Power Administration (BPA), which services demand in the US Pacific Northwest largely via hydropower currently maintains a weather-related financial risk management strategy that relies on traditional tools, but these no longer appear sufficient to meet its goals. This work expands on existing research that characterizes weather-related financial risk by identifying novel financial instruments that can be used to mitigate weather risk faced by a hydropower dependent electricity provider. This analysis employs a regional power systems model and synthetic weather and streamflow generator, coupled with a financial model to identify the hydrometeorological conditions that lead to significant financial risks for BPA. This modeling framework is used to assess the effectiveness of BPA’s current risk management strategy using stochastically generated weather and electricity market scenarios. Several newly developed index-based instruments are then tested in terms of their ability to improve the performance of BPA’s current risk management strategy. Trade-offs between the use of both new and existing tools, variations in strategies employing them in different proportions, and the impact of fluctuating electricity prices on weather-based hedging strategies are also investigated. Lessons learned should be applicable to any electricity providers with significant hydropower in their portfolio, particularly those with few risk management tools available to protect against weather risk.

Related Publications:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Cuppari, R. I.D, Denaro, S.P, Su, Y.D, Kern, J. D., and G. W. Characklis. “Comparing Alternatives for Managing Financial Risk for Hydropower Suppliers,” (in prep)

Collaborators:

Dr. Chad Higgins, Oregon State University

Dr. David Rupp, Oregon State University

Dr. Natalie Voisin, Pacific Northwest National Laboratory

Other Publications from this Project:

Hill, J.M, Kern, J. D. Rupp, D. E., Voisin, N. and G. W. Characklis (2021). “The Effects of Climate Change on Interregional Electricity Market Dynamics on the U.S. West Coast,” Earth’s Future, 9, e2021EF002400, https://doi.org/10.1029/2021EF002400

Cuppari, R., I.M, Higgins, C. W. and G. W. Characklis (2021). “Financial Analysis of Co-locating Agricultural Production and Solar Power Generation,” Applied Energy , 291, 116809, https://doi.org/10.1016/j.apenergy.2021.116809

Su, Y.M, Kern, J. D.R and G. W. Characklis (2017). “The Impact of Wind Power Growth and Hydrological Uncertainty on Financial Losses from Oversupply Events in Hydropower-dominated Systems, Applied Energy, 194, pp. 172-183, doi:10.1016/j.apenergy.2017.02.067.

Funding Support:

National Science Foundation, Innovations at the Nexus of Food, Energy, Water Systems (INFEWS) program, award no. EAR-1740082

UNC Institute for the Environment