Center on Financial Risk in Environmental Systems: Great Lakes

Great Lakes

Project 1 Title:

Hedging the Financial Risk from Water Scarcity for Great Lakes Shipping

Summary:

Low water levels in the Great Lakes can have significant financial impacts on the region’s commercial shipping, which transports hundreds of millions of dollars worth of bulk goods each year. Cargo capacity is a function of a ship’s draft, the distance between the water level and the ship’s bottom, and lower water levels force ships to reduce cargo loads to prevent running aground in shallow harbors and locks. Financial risk transfer instruments, such as index-based insurance contracts, may provide an adaptable method for managing these financial risks.

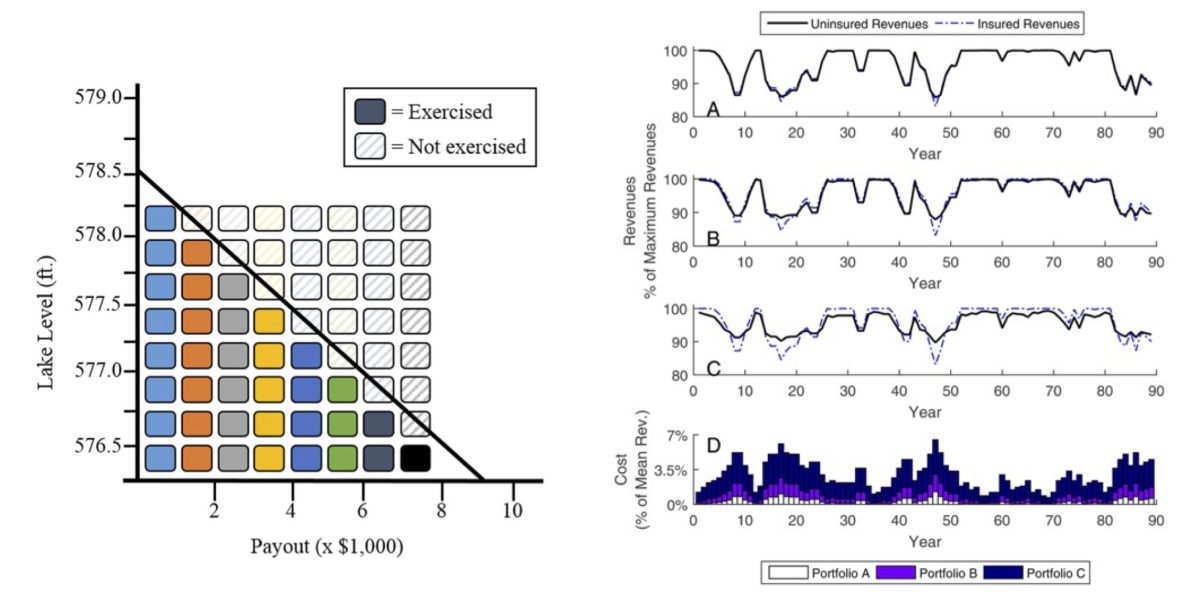

(left panel) Illustrative schematic of a portfolio of binary insurance contracts indexed to Great Lakes water levels. (right panel) Historical revenues for a shipment of coal with and without three binary contract portfolios, as well as the insurance cost for each portfolio. The three portfolios have a target revenue protection of (a) 85% (Portfolio A), (b) 90% (Portfolio B), and (c) 95% (Portfolio C) of maximum revenue, with uninsured revenues (dotted blue) and insured revenues (black). (d) The insurance cost for each of the three portfolios is shown.

Description:

In this work, a relationship between water levels and shipping revenues is developed and used in an actuarial analysis of the frequency and magnitude of revenue losses. This analysis is used to develop a standardized suite of binary financial contracts which are indexed to water levels and priced according to predefined thresholds. These contracts are then combined to form hedging portfolios with different objectives for the shippers. Results suggest that binary contracts could substantially reduce the risk of financial losses during low lake-level periods and at a relatively low cost (1-3% of total revenues), depending on coverage level.

Related Publication:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Meyer, E. S.D, Characklis, G. W., Brown, C. M. and P. Moody (2016). “Hedging the Financial Risk from Water Scarcity for Great Lakes Shipping,” Water Resources Research, 52, pp. 227-245, doi:10.1002/2015WR017855.

Project 2 Title:

Integrating physical and financial approaches to manage environmental financial risk on the Great Lakes

Summary:

Physical and financial approaches each provide different benefits for managing environmental financial risks. Index insurance contracts, a financial approach, have been proposed for managing numerous environmental financial risks. A method for testing when and how physical (dredging) and financial risk management strategies (index insurance) could be deployed in tandem to maximize improvements in utility for commercial shippers on the Great Lakes is developed using principles from benefit-cost analysis and expected utility theory.

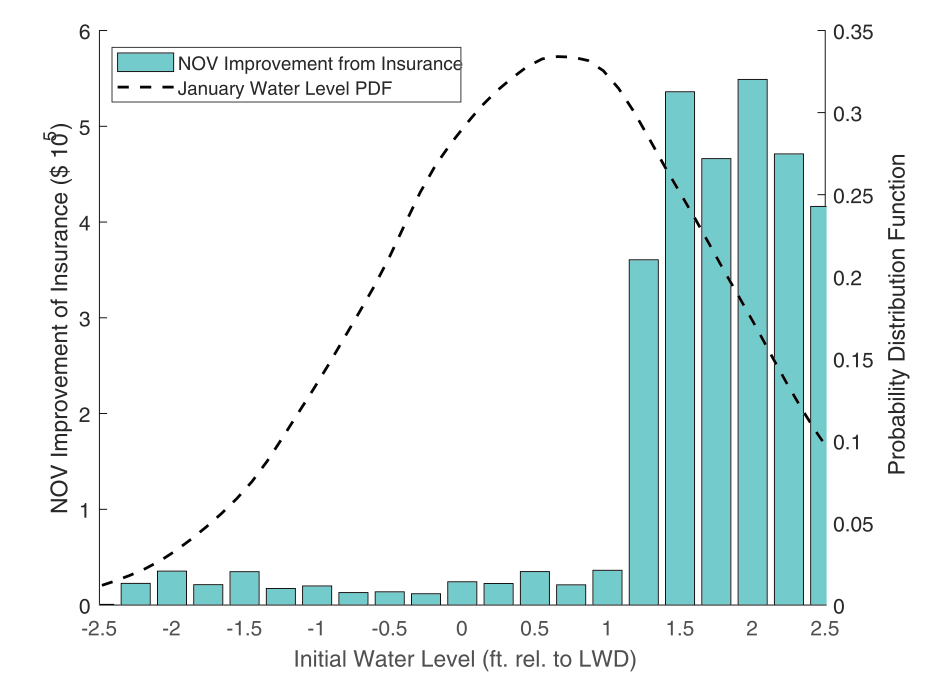

Improvement in the value (measured as “Net Option Value” (NOV)) attributable to insurance in the most favorable risk management strategy, and the cumulative distribution function of initial water levels.

Description:

Combining physical strategies and financial risk management strategies can improve utility for commercial shippers facing low water levels. A valuation method that includes uncertainty in costs and benefits is used to pick the optimal combination of physical and financial risk strategies. Using a utility function with a decreasing marginal utility of income explicitly models the risk aversion of commercial shippers. The probabilistic nature of future revenue and costs is modeled and combined with the utility function to determine a Net Option Value. This value represents the maximum amount commercial shippers would pay above the cost in order to reduce variability in net revenues. Results indicate that while the Net Option Value for dredging exceeds the potential benefits of using insurance contracts alone, the combination of dredging and insurance can improve overall utility for a lower cost than dredging alone.

Related Publication:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Meyer, E. S.D, Foster, B. F.D, Characklis, G. W., Brown, C. M. and A. J. Yates (2020). “Integrating physical and financial approaches to manage environmental financial risk on the Great Lakes,” Water Resources Research, 56, e2019WR024853, doi.org/10.1029/2019WR024853

Collaborators:

Dr. Casey Brown, University of Massachusetts, Amherst

Dr. Andy Yates, Economics, UNC

Other Publications from related projects:

[superscripts denoting graduate students (M = masters; D = doctoral) and Post-doctoral Researchers (P) or Researchers (R)) working in CoFiRES]

Meyer, E. S.D, Characklis, G. W. and C. M. Brown (2017). “Evaluating Financial Risk Management Strategies Under Climate Change for Hydropower Producers on the Great Lakes,” Water Resources Research 53, doi:10.1002/2016WR019889.

Funding Support:

Hydro Research Foundation [include icon] UNC Institute for the Environment [include icon]